Prevent harm – an admirable security objective and pursuit.

However, it’s easier said than done, particularly in the case of identity fraud.

While there are many security solutions on the market that help with identity fraud, they’re commonly focused on fraud after it has already occurred. One of the reasons we see credit card fraud ballooning is because so many of the solutions available today are reactive.

To actually prevent harm to an organization and individuals, we have to prevent fraud, not try to fix it after it’s happened.

What’s missing from traditional credit card fraud services

The way credit card fraud services are set up today, there is a gap in addressing credit fraud in its entirety. Traditional credit card fraud products and services put too much weight on the transaction history. By the time a transaction is recorded, fraud has already happened.

Traditional services are still valuable to stop further fraud, but these methods will never put criminals out of business. Cybercriminals merely change their tactics instead of being stopped. And they’re driven to pursue a numbers game, racing against legacy fraud protection methods by implementing processes that scale.

The burden – and opportunity – for credit card, gift card, and loyalty card issuers

When thinking of your business’ brand reputation, there’s an opportunity to solidify trust between your company and the consumer, and that opportunity exists when you can prevent fraud from happening at all.

When a consumer chooses a credit card, gift card, or loyalty card, they put a lot of trust in that business or financial institution to not only enable transactions on their behalf, but to do so securely, while also protecting their personal and financial data.

And for security teams at card-issuing institutions, there’s the hard task of protecting not only the business, but also safeguarding consumer’s information and ensuring account integrity.

It’s a big ask, and a big burden, but shifting to a point where we prevent credit card fraud lightens the load and creates better outcomes for everyone.

Compromised credit card insights to prevent fraud before it happens

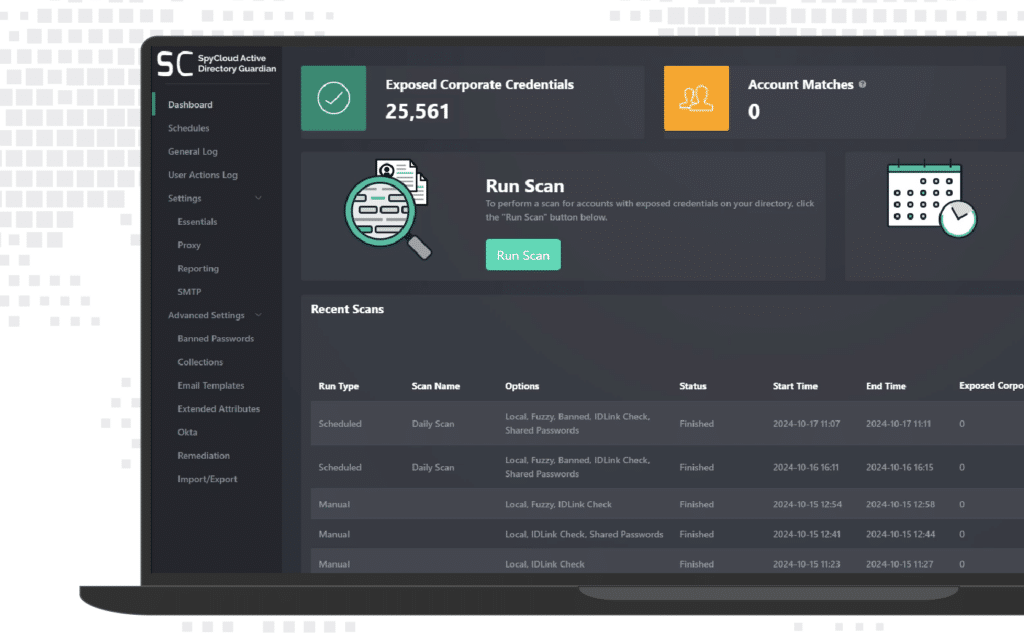

To address the reactive fraud challenge in the financial and retail industries, SpyCloud has released a new Compromised Credit Card API – allowing institutions or companies who issue credit cards, gift cards, and loyalty cards to automatically monitor and detect exposed card numbers.

With these insights in hand, security, application, and fraud teams can shift their focus to pre-fraud activity and more quickly remediate compromised cards before any fraud or financial crime can happen.

Not only do these insights help with preventing fraud, but they also reduce the burden on teams from post-transaction fraud, reducing monetary losses to the business, and upholding consumer trust in your brand.

How the Compromised Credit Card API works

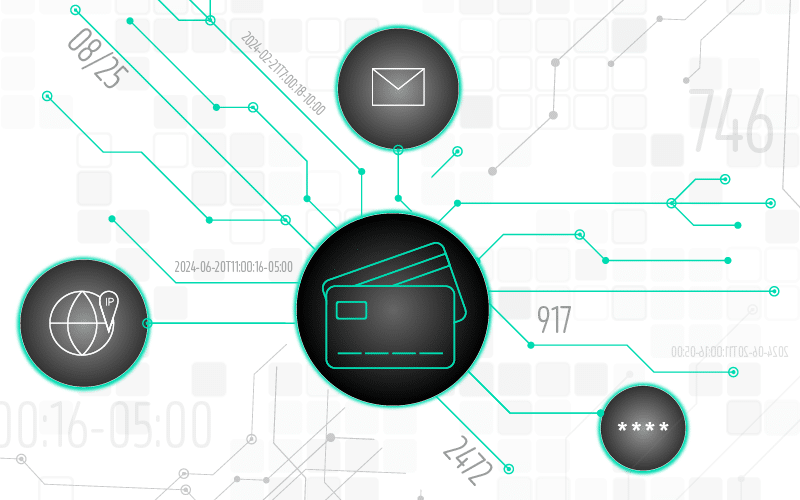

The SpyCloud Compromised Credit Card API helps to automate exposure remediation, returning exposed credit card records from a query of six-character BIN(s). A customer system or user can then query a compromised endpoint using one or multiple BIN(s) and receive all matched credit card records, with credit card numbers returned as SHA1 hash.

Some of the API fields include:

- Credit card number

- BIN

- Last four digits of card

- Card expiration date

- CVV code

- IP address of infected system

- User email

- The time when the user’s system was infected with malware

How the Compromised Credit Card API helps credit card issuers & fraud teams

To win the fight against fraud, you have to beat criminals at their own game. Our mission here at SpyCloud is to disrupt cybercrime – by acting on what criminals know about your business and your customers. We recapture and analyze what is already in threat actors’ hands to prevent them from using it to victimize people and companies.

The SpyCloud Compromised Credit Card API allows card issuers to handle known exposures, instead of dealing with future fraud. It changes the game by avoiding the fraud transactions in the first place. Issuers can opt to either proactively re-issue replacement cards or add more stringent approval controls to transactions.

The API, in other words, changes fraud handling from reactive to preventative and allows organizations to better manage potential fraud losses and impacts to brand reputation by maintaining customer trust and loyalty.

SpyCloud’s Consumer Risk Protection solution delivers compromised data insights at the first sign of exposure on the dark web, preventing account takeover and fraud.