Underground data – the missing component of your fraud prevention framework

SpyCloud helps enterprises preserve profits and unlock revenue by delivering actionable, predictive fraud risk insights for their consumers based on breach and malware data recovered from the criminal underground.

WHO USES SPYCLOUD?

Stop hard-to-detect fraud with actionable analytics from the deep and dark web

Prevent

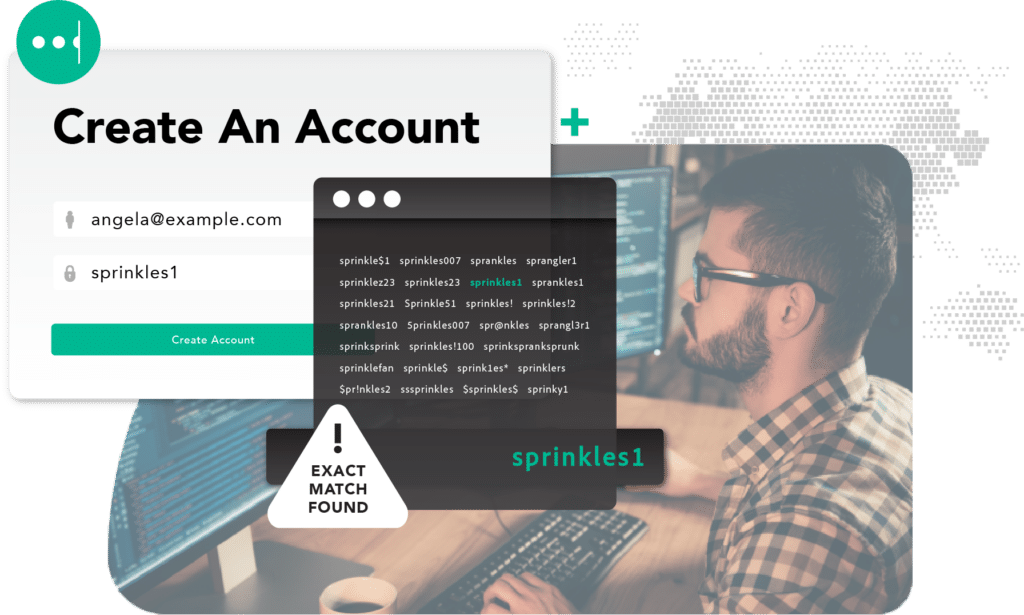

ATO fraud

Prevent fraudulent account creation using previously exposed credentials – with real-time alerts as soon as consumers’ exposed data appears in the criminal underground

Detect

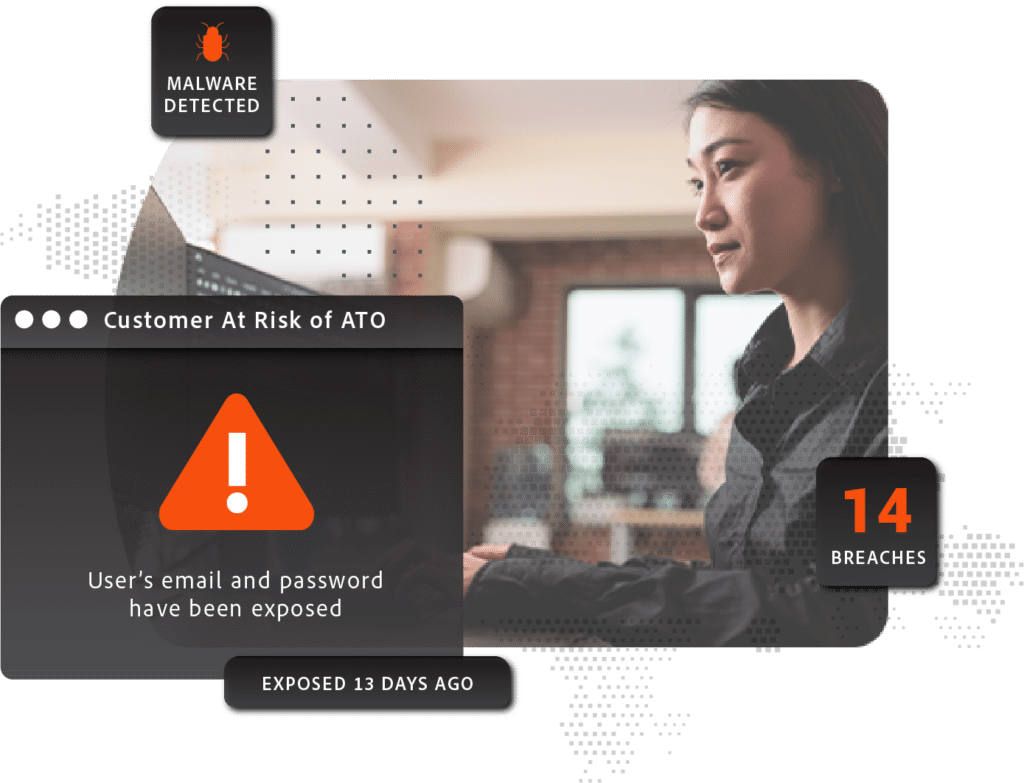

compromised accounts

Leverage recaptured malware data to alert enterprises when consumers’ web sessions are compromised so they can react appropriately to prevent session hijacking

Preserve

customer trust

From account creation to digital transactions – safeguard your consumers’ digital experiences to ensure brand loyalty and trust

Make more informed fraud decisions at scale

SpyCloud’s data empowers businesses to prevent fraud losses by preemptively identifying exposures within the criminal underground that can be used by criminals to take over accounts.

Preserve profits, optimize resources

SpyCloud’s unique ability to detect malware-infected users strengthens defense mechanisms against emerging ATO techniques. This proactive approach to securing customer accounts not only boosts customer loyalty and reduces attrition, but allows for better allocation of analyst and fraud prevention resources.

Take action with confidence

Enable fraud teams to increase confidence in their fraud prevention frameworks and risk models with a detailed view of a customer’s exposures across the darknet. Insights into no exposures vs recent and high-risk exposures allows fraud teams to enhance the accuracy of their risk assessment and automate the user's journey.

Better data, increased efficiency

SpyCloud delivers high-volume, fresh, actionable breach and malware data via performant APIs for easy integration and automation within your existing applications, workflows, and predictive models to prevent fraud – enabling faster and better fraud decisioning for manual reviews and post-fraud investigations.

Dynamic thresholds, better experiences

Fraud teams can tailor the customer’s journey based on their individual risk, allowing users with little to no exposures to interact friction-free, while implementing the appropriate step-up authentication for compromised accounts – even blocking transactions or logins for highest risk, malware-infected users.

“Since SpyCloud recaptures credentials directly from the criminal underground, we now have a level playing field with fraudsters – with the same data, we can easily identify compromised consumers and be more proactive in protecting them.”

– Ecommerce Marketplace Leader

Explore SpyCloud

Enterprise Protection

Reduce your risk of ransomware and other critical attacks – acting on known points of compromise

Learn more

Consumer Risk Protection

Take a proactive approach to combating account takeover and stop high-risk attacks tied to malware

Learn more

Investigations

Efficiently piece together criminals’ digital breadcrumbs to reveal the identities of specific adversaries engaging in cybercrime

Learn more

Data Partnerships

Access comprehensive breach and malware data to add value to security and fraud detection products and services

Learn more

SecOps

Efficiently secure employee identities and safeguard corporate data and critical IP from cyberattacks.

Learn more

Threat intel teams

Investigate and stop threats with insights well beyond raw data and IOCs

Learn more

Cybercrime Analytics

Learn about the new way to disrupt cybercrime with automated analytics that drive action

Learn more

Test our data

We’re confident you’ll get more matches with SpyCloud – let’s do a match rate test

Learn more

Check your exposure

Uncover threats to your organization like malware-infected employees, stolen session cookies, and recency of breach exposures

See your results

Fight back against fraudsters

Dive into a case study

Learn how a Top 10 Online Travel Booking Site discovers up to 11,000 exposed consumer accounts every hour.

Connect with us

Experience how SpyCloud can help you prevent fraud without impacting the digital experience.